Are you an employee who needs additional funds for health care, education, home repair and small business costs? You can now tap your online social network to get a loan. No collateral is needed and the interest rates are low. Everything is done online, quickly.

Lenddo Philippines aims to help the emerging middle class to have access to financial services using social media as its platform. Lenddo will lend you money based on your online connections and behavior. You are given a credit score called the Lenddo score which is affected by your online community.

Joining the Lenddo Community

To join the Lenddo community, register on its website. You link your Lenddo account to your social media accounts, namely, Facebook, Yahoo, Gmail and LinkedIn. You then invite family and friends from these networks to join Lenddo. They form part of your trusted network that will vouch for your creditworthiness. As you build your trusted community, you also build your credit score or Lenddo score. A minimum Lenddo score of 400 qualifies you to apply for a loan, provided you have at least three members of your trusted network each having a minimum Lenddo score of 400, with at least one of those being a family member and one a co-worker.

While only those who are employed may apply for loan, anyone who is 18 years old and above can join the community. The unemployed can build up their Lenddo score, and everyone can learn from the money management tips that the site features.

As with other money matters, it is important that we realize the value of getting the right financial advice and support from people whom we should trust. Just because Lenddo uses the social network platform doesn’t mean that we should invite all our so-called “friends” in the network. Remember that your credibility and creditworthiness is determined by the people in your network. Each one’s Lenddo score affects all the other Lenddo scores within a trusted network. If a person in your network is not able to pay for a loan, that will have a bearing on the Lenddo score of everyone in your network. So choose wisely those who you will invite in your network.

Applying for a Loan

Applying for a loan is easy once you have built a trusted network. Once logged in the Lenddo site, click on the Loan tab, then Apply for a Loan. There, some basic personal information, including employment information and financial information are required. You then fill out a loan form where you state the purpose and amount of the loan. Note that the loan should be for life improvement purposes only, like health care, education, home repair, debt consolidation and business. The interest rate is determined by several factors: your Lenddo score, the loan purpose and your ability to pay back a loan. The application is evaluated in as short as one day and if approved, the amount is credited directly to your bank account. There is no limit to the number of loans that you can avail. But you have to fully pay an existing loan to be eligible to apply for another one.

Friend-o-Meter: Facebook Game To Educate Filipinos About Trusted Communities

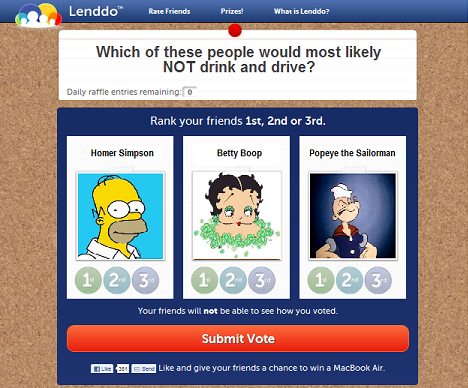

Being an online community, Lenddo recently launched Friend-O-Meter, a Facebook game through which Lenddo hopes its members learn the importance of trusted communities. In the game, players rank their Facebook friends’ trustworthiness against a range of simple questions like, “Which of these people would most likely not drink and drive?” Each vote that a player makes is equal to one raffle entry. Fabulous raffle prizes are at stake in the grand draw on August 16: MacBook Air, 32-inch LCD TV and a digital camera. Prizes in the weekly draws are iPod shuffles.

Advantages and Disadvantages

Lenddo’s promise of easy access to credit is commendable. Access to financial services is given to people who previously may have none. This access may be the defining opportunity for many to lead better lives.

But I see its social media platform as both its advantage and disadvantage. The application process is made easy by its online platform which is regularly accessed by its target market. However, there may be problems down the road with privacy and security issues. Since information is shared among members of a trusted network, there may be leakages of information that might result to damaged relations among members of a network, which might ultimately damage the service. There’s also the problem of online scammers, who have carefully built fake online identities in various social media accounts. I hope that these issues are being adequately addressed by Lenddo.

More information on Lenddo on its Facebook page: www.facebook.com/lenddoPlease share your questions and comments in the comment box below.